Matthew Graham wrote in the Mortgage Daily News, July 15, 2022, about mortgage rates:

“It was a week for paradoxes on several fronts, most notably when mortgage rates moved lower just after the Fed floated the idea of an even bigger hike.

There’s a popular misconception that the Fed sets mortgage rates or controls them directly in some way. They don’t.

The Fed sets the Fed Funds Rate (FFR), which applies to loans between big banks for less than 24 hours. Mortgage rates are controlled by bonds that last years. FFR is a short-term rate, and mortgages are longer-term.” The ten-year treasury yield correlates very well with mortgage rates.

“The only major exception is when the Fed changes its bond-buying plans. Those bond purchases directly impact mortgage rates because they include the bonds that underlie the mortgage market as well as other longer-term bonds that move in concert with mortgages. All that having been said, we haven’t had any big news on Fed bond buying in months.

The other reason mortgages don’t care about the Fed Funds Rate is that the Fed only meets eight times a year, whereas mortgage rates change every day (sometimes more than once!). That means mortgages, as well as the rest of the bond market, can move well in advance of the Fed actually pulling the trigger.

In fact, betting on future Fed rate hikes is big business. Securities known as Fed Funds Futures trade for exactly this purpose. They go a long way in explaining this week’s paradoxical movement.

The bottom line is that although we have high inflation and high Fed rate expectations today, the market increasingly foresees a scenario where the combination of those factors squeezes consumers to the point that inflation falls significantly. Because longer-term rates like 10yr Treasuries and mortgages are more aligned with longer-term expectations, they’ve been the first to benefit as the narrative shifts. Both are still elevated from a recent historical standpoint, but both are well off their mid-June highs and have generally declined since then.”

So how does a buyer navigate this mortgage rate seesaw? Economists’ are predicting that the Fed rate hikes will cause slower growth, or a recession, resulting in lower interest rates in the future. The Mortgage Bankers Association expects mortgage rates to decline to 4.4% by 2024. So, what kind of a mortgage should your buyer apply for when purchasing a property? The following is a suggestion from a newsletter in the Phoenix market by Beacon Property Solutions for buyers that are financing their purchase.

“Cue the interest rate buydown, a seller concession tool that has been collecting dust, unneeded for well over a decade. The reason price reductions have had a negligible effect on affordability is a $10,000 price reduction only saves a buyer $53 on their mortgage payment at 5.8%. However, for a similar cost, a seller can buy down a buyer’s mortgage rate and save them $100’s on their monthly mortgage payment, either permanently or temporarily depending on the plan. Doing so puts a seller’s property at a higher competitive advantage than just a straight up price reduction.”

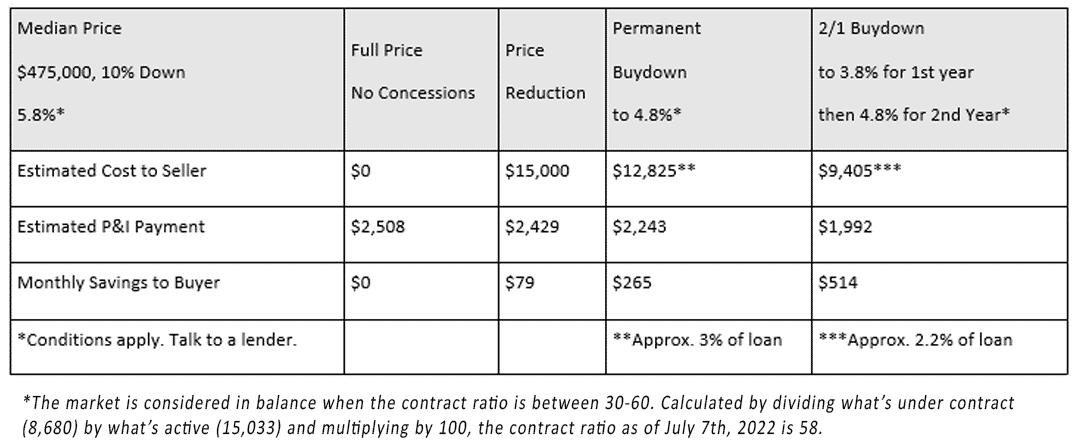

Here is a sample comparison of price reduction vs. rate buydown options:

In this example, if a buyer got a permanent buydown to 4.8% on a 30-year $427,500 purchase mortgage, they would save $95,400 or almost one quarter of the mortgage. The monthly savings for the adjustable mortgage is even greater, and if rates do decline again before the rate adjustment date, they can refinance into a 15 or 30-year fixed rate mortgage.

Reach out to our experts for any further questions on mortgage rates, visit our website at coloradotitleservices.com!